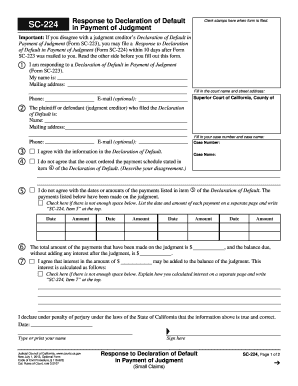

CA SC-224 2024-2025 free printable template

Show details

Este documento permite a un deudor del juicio responder a una Declaración de Incumplimiento en el Pago de un Juicio (formulario SC-223), indicando si está de acuerdo o en desacuerdo con la información

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sc 224 small claims form

Edit your sc 224 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your declaration default payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ca default payment judgment online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sc 224 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA SC-224 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out payment receive form

How to fill out CA SC-224

01

Obtain the CA SC-224 form from the relevant court or online.

02

Fill in your name and contact information in the designated fields.

03

Provide details about the case, including the case number and title.

04

Describe the specific request or relief you are seeking in a clear and concise manner.

05

Indicate the reason for your request and any relevant supporting information.

06

Sign and date the form at the bottom.

07

File the completed CA SC-224 with the appropriate court and keep a copy for your records.

Who needs CA SC-224?

01

Individuals who are seeking to appeal a decision made by a California court.

02

Parties involved in a legal case who wish to request a modification or adjustment to a court order.

03

Attorneys representing clients in California who require a formal request for specific court actions.

Fill

form sc 223

: Try Risk Free

People Also Ask about response default payment

What is a payment request form?

A payment request form is used to request payment for goods or services. It can also be used by employees to request funding from a finance team or HR department. The purpose of this Payment Request Form is to provide a professional, straightforward way to request payments.

How do I create a payment form?

Designing the Perfect Payment Form in 9 Steps Step 1: Keep Them on Your Site. Step 2: Offer Multiple Payment Methods. Step 3: Don't Require an Account. Step 4: Assure Customers Their Data Is Safe. Step 5: Ask Simple, Logical Questions. Step 6: Remove Unnecessary Fields. Step 7: Identify Customers' Errors.

What is the document for receiving payment?

A receipt is a written document acknowledging a payment that has been made. A receipt is commonly issued after an invoice has been paid and includes transaction details, such as payment method.

How do you write a receipt for money received?

Template The date on which the transaction happened. The unique number assigned to the document for identification. The name of the customer. The amount of cash received. The method of payment, i.e., by cash, cheque, etc.; The signature of the vendor.

How do I create a payment form in Google?

Payments info. The "Payments" tab is selected by default. Click Add payment method. If there are existing forms of payment, you may need to click Manage payment methods first and then click Add payment method. Select the account type and enter your account information.

How do I create a payment method form?

Designing the Perfect Payment Form in 9 Steps Step 1: Keep Them on Your Site. Step 2: Offer Multiple Payment Methods. Step 3: Don't Require an Account. Step 4: Assure Customers Their Data Is Safe. Step 5: Ask Simple, Logical Questions. Step 6: Remove Unnecessary Fields. Step 7: Identify Customers' Errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 6500 224 blank for eSignature?

When your CA SC-224 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get CA SC-224?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the CA SC-224 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my CA SC-224 in Gmail?

Create your eSignature using pdfFiller and then eSign your CA SC-224 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is CA SC-224?

CA SC-224 is a California state form used to report sales and use tax returns.

Who is required to file CA SC-224?

Businesses and individuals who have sales tax obligations in California are required to file CA SC-224.

How to fill out CA SC-224?

To fill out CA SC-224, provide details such as your business information, sales figures, and applicable tax rates. Follow the form instructions and guidelines.

What is the purpose of CA SC-224?

The purpose of CA SC-224 is to collect sales tax revenue from businesses operating in California and to ensure compliance with state tax laws.

What information must be reported on CA SC-224?

CA SC-224 requires reporting of sales amounts, deductions, taxable sales, and the total sales tax owed for the reporting period.

Fill out your CA SC-224 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA SC-224 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.